Seventy-eight percent of Americans live paycheck to paycheck, according to a study released from CareerBuilder. Further, more than half of the workers surveyed believed they would always live in debt.

If this sounds familiar, and you find yourself broke and struggling to work your way out of it, you are clearly far from alone. With a solid strategy and firm commitment, you can bounce back from being broke and go on to thrive. Here are four strategies that can help:

1. Decide to Make a Change and Don’t Dwell on the Past

Everyone makes bad decisions in one aspect of their life or another, and it is easy to beat yourself up over it, but it won’t get you anywhere. If you neglected to save, or you incurred a heap of debt, it is important to decide to correct the situation as soon as possible, let it go and forgive yourself, and commit to a new strategy to improve your financial portfolio.

2. Increase Your Income

Ask for a raise at your current job or polish up your resume to look for a higher paying job, or at least one with greater earning potential. Another option is to look for a part-time job, which might include freelancing, dog walking, lawn mowing, house repairs, selling items on eBay or Craigslist, or pizza delivery. Anything that pushes you further into the black will help you start breathing easier.

3. Invest in Identity Theft Protection

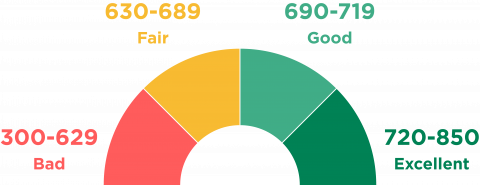

As you continue to restore your financial health, perhaps adding a new credit card to the mix to boost your credit score, it’s critical to protect your identity from thieves. Investing in identity theft protection from an industry leader like LifeLock will help keep you safe throughout the process of improving your finances. Currently, you can get special offer for a LifeLock discount to help keep your identity safe without breaking your new budget.

When using this limited time promo code for 30 percent off your first year’s fees, you can take advantage of the following features:

-

Free credit scores and annual credit reports

-

Monitoring and alerts for SSN, credit and financial accounts

-

Scanning for identity theft and reduced junk mail

4. Cut Your Spending in a Variety of Ways

You might be surprised at the number of ways you can reduce your spending. It doesn’t have to be painful; chances are you will appreciate it once you start seeing how much money you’re saving instead of wasting it at Starbucks or the local deli. Start by taking one category, such as entertainment or dining out, and give yourself a modest allowance. Take an honest look at what you spend on that category each month, then commit to reducing it to 25 percent of that each month. The next month, if all goes well, reduce it further.

By committing to cutting spending, earning more, protecting your identity and giving yourself a break, along with several other strategies, you can clear the slate and enjoy a happier and less stressful financial future.