Financial experts are predicting that the Corona Virus is going to cause a recession in the United States.

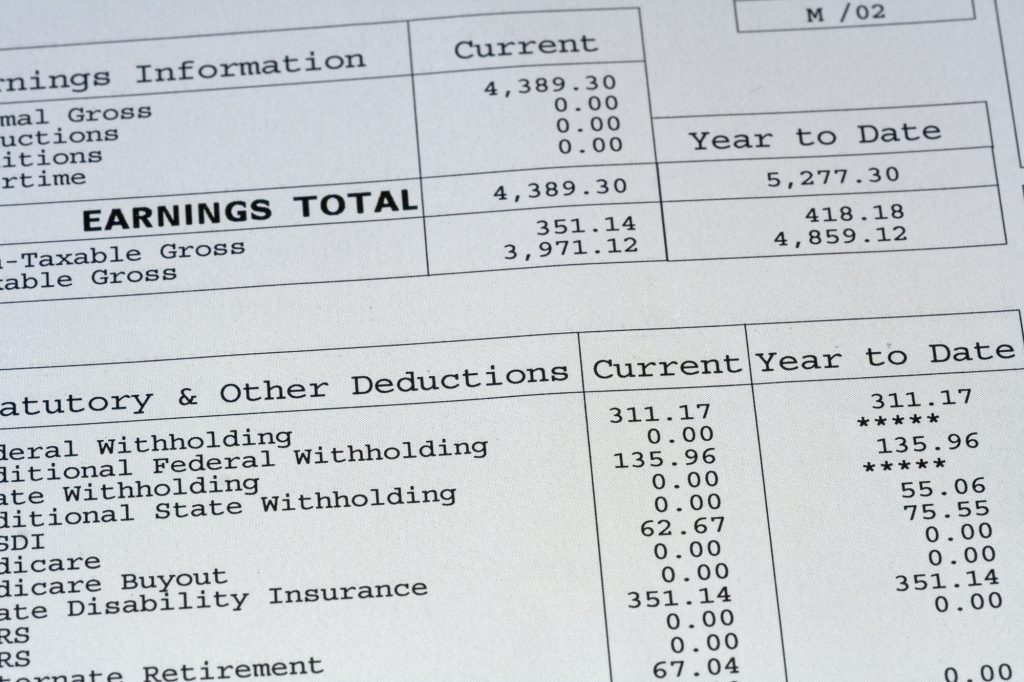

During these uncertain times, it’s more important than ever to pay close attention to your financial details. If you haven’t bothered to review your pay stub generator in a while, this is a great time to do that.

But, before you get overwhelmed by all the pay stub abbreviations, keep reading so you’ll know exactly what your pay stub says.

FWT or FITW

When viewing your pay stubs online, you’ll find that a lot of the abbreviations deal with deductions. The first abbreviation that might catch your eye is FWT or FITW.

The number beside this abbreviation represents your Federal Withholding Tax or Federal Income Tax Withholding. This is the amount of money that is taken out of your check and is sent directly to the federal government.

SWT or SITW

The next paycheck stub abbreviations you may come across are SWT or SITW. These abbreviations stand for State Withholding tax or State Income Tax Withholding.

Similar to your FWT, this is the amount of money that is taken out of your check and sent to the state government. This number is usually much smaller than your federal withholdings.

If you don’t see these abbreviations, don’t panic. You may live in one of the nine states that don’t collect income tax.

INS, MED, SS

There are two other common payroll abbreviations that you might find listed with your deductions. These abbreviations are a little more obvious but are still important to know.

INS represents the amount of money deducted for your insurance. This number can vary greatly depending on your workplace’s plan, your amount of coverage, and if you have any dependents under your insurance. You should be reviewing your insurance needs yearly to make sure you’re covered adequately but not paying too much.

Next, you may see the abbreviations MED or SS. These represent the education for Medicare and Social Security. Nearly all paystubs will have these deductions.

401K or RET

Finally, the last paycheck stub abbreviations you may see are 401K or RET. This represents the voluntary deductions you have set up for your retirement plan.

If you participate, you’ll see a certain percentage of your paycheck deducted for your retirement each month.

Along with your retirement withholding, if your employer offers a match, this should be listed as well. If you don’t see any information regarding the company’s match on your payroll, you may want to check if you qualify.

Know Your Pay Stub Abbreviations

These are the main pay stub abbreviations you’ll come across when getting paid.

If you come across any other abbreviations or are unsure about any aspect of your pay stub, don’t hesitate to reach out to your HR department. One of their main jobs is to answer any and all questions you may. When it comes to your paycheck, it never hurts to double-check that the details are correct!

Looking for more ways to take control of your financial future? Browse some more articles for personal finance advice today.